Expenses in a business come from various sources—supplier payments, employee reimbursements, utility bills, office supplies, and more. Managing these becomes overwhelming, especially when they come in different formats and at varying intervals.

With Xero, you can centralize all these expenses in one place, making it easy to track, record, and manage them efficiently. You can capture receipts, log recurring payments, and categorize expenses with ease. Xero also offers features like automated bank reconciliation and expense reporting, giving you a clear view of your financials.

By centralizing expense management, Xero gives you control over your business’s cash flow.

This blog will explore these features and guide you to effectively manage expenses with Xero.

How to Keep Track of Expenses in Xero?

Xero offers a variety of tools that make managing and monitoring expenses easy and efficient.

Here's how you can keep track of your expenses using Xero:

Claim Expenses in Xero

Xero simplifies expense tracking by allowing you to claim various business-related expenses, such as mileage and employee reimbursements.

Here’s a step-by-step process for managing expense claims in Xero:

- Go to the Business menu and select Expenses.

- Click on + New Claim to start a new expense claim.

- Fill in the details for the expense, including the date, description, and amount.

- Upload any receipts or supporting documents related to the expense.

- If claiming mileage, select Add Mileage, enter the distance traveled, and provide the purpose of the trip. Xero will calculate the reimbursement based on the rate set in your account.

- Once all details are entered, review the claim and submit it for necessary approval.

- Monitor the status of your claims under the Expenses section.

Manage Bills in Xero

Xero’s bills management feature helps you stay organized and on top of your supplier payments. You can record supplier invoices, set due dates, and schedule payments all within the platform.

Here’s a step-by-step process for processing bills in Xero:

- Click on the Business menu and select Bills to Pay.

- Click + New Bill to record a new supplier invoice.

- Input the bill date, supplier name, and invoice number. Enter the total amount and categorize the expense.

- Upload any relevant documents or invoices.

- Specify the payment due date to help manage upcoming payments.

- Save the bill. If required, submit it for approval.

- Once approved, schedule the payment or mark it as paid when done. Monitor outstanding bills from the Bills to Pay section.

Reconcile Expenses with Bank Transactions in Xero

One of Xero’s most powerful features is its automatic bank reconciliation.

Xero connects directly to your bank account, automatically importing your transactions daily. It then matches these transactions with the recorded expenses in Xero, allowing you to review and approve the matches.

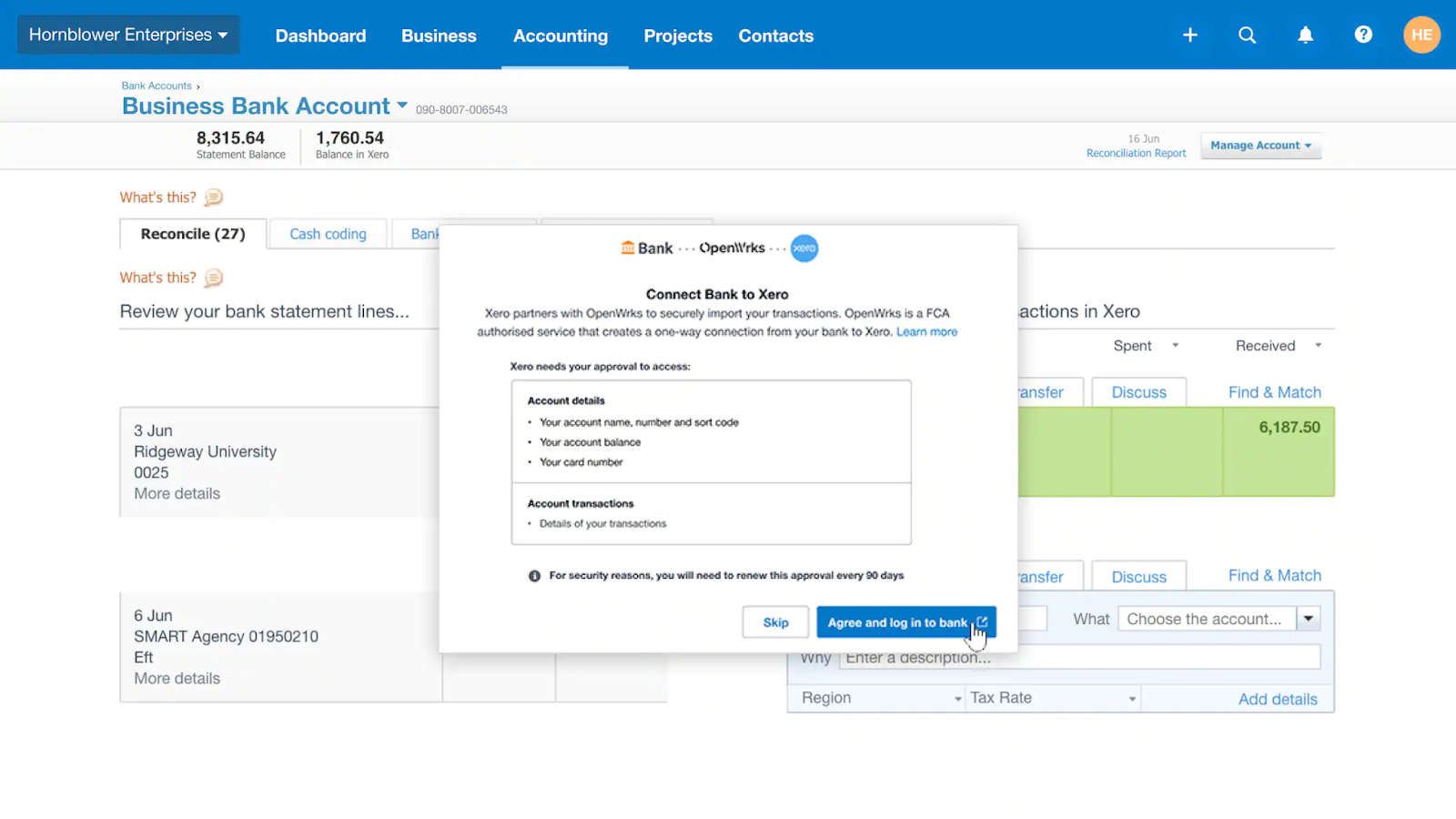

Here’s a step-by-step process for setting up bank feeds in Xero:

- Go to the Accounting menu and select Bank Accounts.

- Click on + Add Bank Account. If you already have an account set up and want to add a new feed, select the relevant bank account.

- Choose your bank from the list. Xero will provide instructions specific to your bank on how to complete the setup.

- You will be redirected to your bank’s online banking portal or a secure banking setup page. Log in with your bank credentials to authorize Xero to access your account information.

- Once the connection is established, Xero will confirm that your bank feed is active. Transactions will start importing into Xero automatically.

- Go back to Xero and navigate to Bank accounts. You should see imported transactions in the Reconcile tab of the respective bank account.

- Under the Reconcile tab, review and match imported bank transactions with your recorded expenses.

- For each matched transaction, confirm that the details align with your records.

- Review any unmatched transactions and manually reconcile them by entering the details or creating a new expense.

Potential Challenges of Manually Managing Expenses With Xero

While Xero offers various features for managing expenses, especially for smaller businesses, at the end of each day, the finance and accounting teams have to manually record and reconcile expenses, ensuring all approvals and maintaining budget compliance.

In many cases, teams wait until the end of the month to review statements and close their books. This process leads to hours spent on manual account reconciliation, increasing the risk of errors and delays.

And while Xero is effective for smaller businesses with simple structures, as businesses grow, manual expense handling becomes inefficient.

In such cases, a dedicated spend management platform streamlines these processes to ease the workload for finance and accounts teams by centralizing all expense sources in one place. It simplifies the entire expense management process, allowing teams to automate tracking, approvals, and categorization of expenses in real time. Integrated with your accounting software, it automatically updates financial records, reducing the need for manual data entry.

By streamlining these tasks, the team avoids spending hours on month-end reconciliations and minimizes the risk of errors or unexpected issues when closing the books.

4 Signs You Need a Dedicated Spend Management Solution

Adopting new software can seem disruptive, especially if you already use tools like Xero. However, as businesses grow, teams spend hours on manual processes to close books on time accurately.

Here are four signs you should consider a dedicated spend management solution.

High Volume of Transactions

When your business handles a high volume of transactions, teams spend hours sifting through piles of receipts, invoices, and financial records to keep records updated, which leads to delays and inaccuracies.

A dedicated spend management solution automates transaction recording and categorization. Employees get a dedicated platform for submitting expense claims with complete documentation, which are routed for automated approvals. Once approved, these transactions are tracked from a centralized dashboard and synced to Xero in real time. This streamlined process ensures that all transactions are accurately captured and integrated into your accounting system, reducing manual workload and minimizing errors.

Approval Bottlenecks

Manual approval processes are fragmented across different platforms, leading to slow turnaround times and delayed reimbursements, especially when multiple approval levels are required.

A spend management platform mitigates these issues by automating approval workflows. It speeds up the expense claim process with configurable approval hierarchies and real-time notifications, ensuring a smoother and more efficient approval process.

Budget Overruns

Traditional manual tracking makes it difficult to gain real-time insights into spending and identify potential overspending early. When expenses are not monitored closely, staying within budget limits becomes challenging, leading to unexpected financial strain.

A dedicated spend management solution improves this by providing real-time visibility into expenses and budget usage. The platform offers detailed reports and analytics, allowing you to monitor and control spending closely. This helps prevent budget overruns and supports more accurate financial planning.

In addition to real-time visibility, you can also switch to corporate cards to further simplify expense management and eliminate month-end surprises. With options to set budget controls and configure each card, you get real-time visibility and control to streamline your budgeting process effectively.

Manual Data Entry Errors

When data comes from various sources, finance teams manually enter expenses into accounting systems. This manual process is prone to error, leading to unreliable financial records and challenges in reconciling discrepancies. The time and effort needed to correct these errors make the process labor-intensive and inefficient.

A spend management platform minimizes these errors by automating data entry and integrating seamlessly with your accounting software. This ensures that all expense data is accurately captured and recorded, reducing the risk of errors and freeing up your finance team to focus on more strategic tasks.

Close Books With Real-Time Visibility and Control

A dedicated spend management platform empowers your entire team—employees, managers, finance, and accounting—by streamlining expense handling and real-time book closing.

Employees benefit from an intuitive interface for submitting and tracking expense claims, while managers can easily oversee approvals and budget adherence. Finance teams get real-time insights into spending patterns and budget usage, allowing for timely adjustments and better financial control. Accounting teams enjoy seamless integration with existing systems, reducing manual data entry and reconciliation tasks.

This centralized approach speeds up the expense management process and ensures that financial records are accurate and up to date. By automating workflows and providing real-time visibility, a spend management platform helps your team handle expenses efficiently and close the books faster.

If you want to find the right expense management software to enhance your operations, check our blog on top 6 expense management software.

.png)

.png)

.webp)

%20(1).webp)