Processing bills is the most difficult part of procurement.

Bill payments are often mistakenly duplicated, goods aren’t received as per purchase orders, or there are delays in the approval workflow.

An accounts payable software makes the process hassle-free by automating approvals and payments and giving more visibility and control over your accounts payable (AP). It also enhances reconciliation and improves vendor relationships.

While the core job to be done by an AP manager is to ensure good vendor relationships, manage between timely payments & cash flow, ensure compliance in payments, what you need is a solution that supports your organization’s finances in one place and ends the chaotic back and forth.

{{less-time-managing="/components"}}

What is Accounts payable software?

Accounts payable (AP) software is a tool that helps businesses automate invoice and vendor payments via a centralized platform. An accounts payable automation software brings together all the key information into a single source of truth and enables teams to do the following:

- Tracks bills and their statuses to avoid double payments

- Enables two-way and three-way goods received note (GRN) & PO matching

- Supports customizable approval workflows for complete visibility

- Supports local and international payments via various payment methods

Thus, AP software simplifies the payment processes and reduces unnecessary friction between finance, procurement & other teams.

Top 7 accounts payable software in 2025

Here are the top 7 AP platforms for businesses.

Based on your company size and needs, you can pick one of these to support your accounts payable.

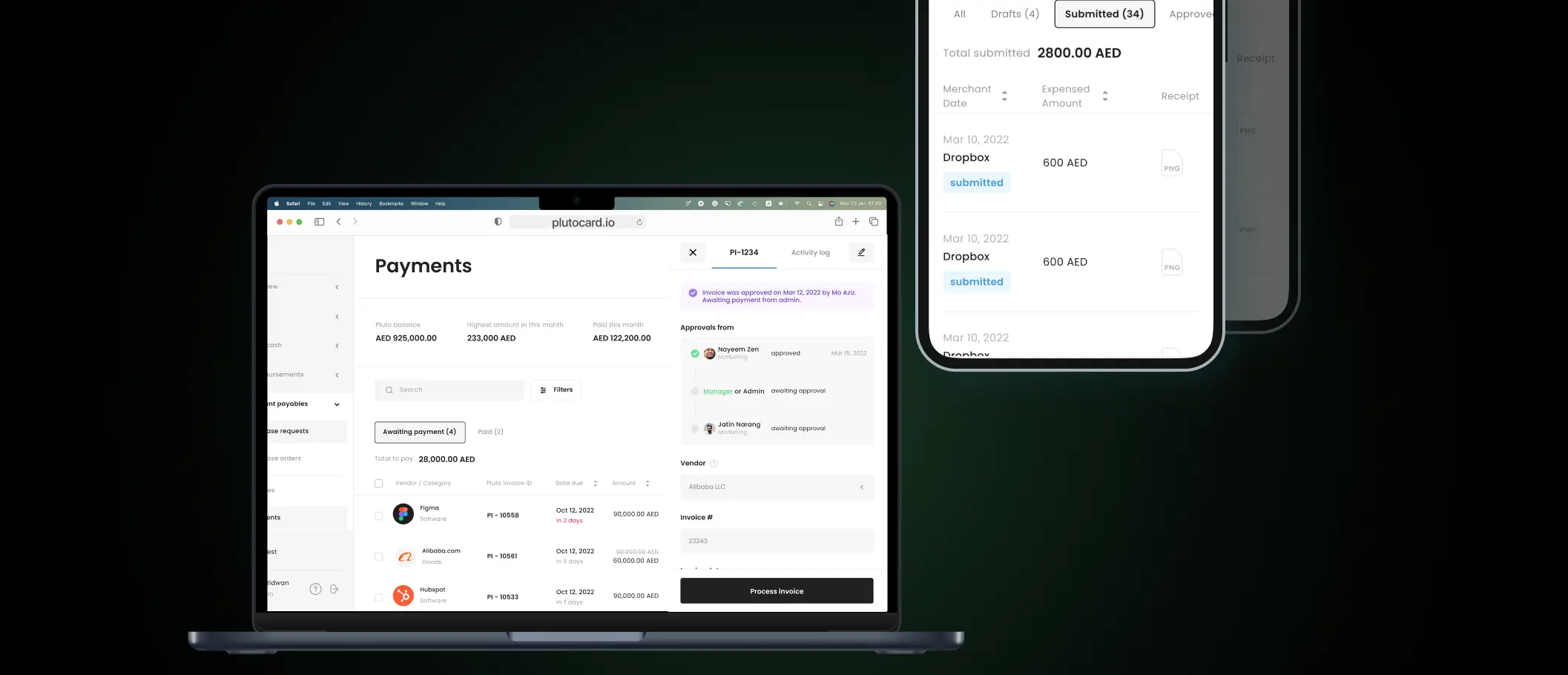

1. Pluto

Pluto is an accounts payable software that transforms your AP processes by simplifying bill processing. From enabling GRN matching to setting fully customizable multi-layer approval workflows, it is the best accounts payable solution to manage your vendor payments and relationships.

Key features:

- Facilitates three-way GRN matching with purchase orders and item-based matching

- Consolidates approved invoices in a single window to highlight pending bills and avoid delays

- Offers a flexible approval engine capable of managing intricate hierarchies without requiring technical expertise

- Enables multi-layer invoice approvals with policies to align with your company's structure

- Ability to upload invoices easily via WhatsApp images and emails directly to speed up the receipt capture process

- A centralized dashboard to gather bills in one place and track the status to avoid double payments

- Vendor-specific corporate cards to control budgets and detect irrelevant expenses

- Enables creation of a preferred vendors list for quick payments

- Supports local and international wire transfers to make payments

- OCR technology minimizes manual data entry by creating and populating bills from invoices

- Supports ERP integration to synchronize your vendors, POs, and bills and integrates with accounting software such as Oracle, NetSuite, Zoho, Quickbooks, Wafeq, Xero, etc.

- Raises alerts for upcoming payments, enables scheduling payments in advance and automates invoices

- Provides a complete audit trail of the process to ensure visibility at each step

- Shows real-time analytics to facilitate deep insights for supporting budget control

Pricing:

Request the sales team for a custom quote.

Pros:

- Enables branch- and subsidiary-level spend tracking (not offered by other platforms)

- Offers up to 2% cashback on all non-AED transactions

- Independent PCI DSS Level 1 certification

- SSO/SAML Capabilities for Enterprises

- Integrates with Netsuite, Microsoft Dynamics

- Better Forex rates than most local banks

- Multiple integration options

Cons:

- Integrates with all other major ERPs except Tally

- Slightly longer on-boarding due to corporate card offering

{{less-time-managing="/components"}}

2. Tipalti

Tipalti is an automation tool that supports end-to-end AP processes. It helps you streamline accounts payables and make global payments in local currencies for various recipients, from suppliers to freelancers. The cloud-based platform helps finance teams manage payments without losing visibility and control.

Key features:

- Supports supplier onboarding and vetting to ensure supplier reliability and trustworthiness

- Integrates with ERP and accounting systems to help with reconciliation reporting

- Uses OCR to scan, capture, match, and process invoice data to reduce manual errors

- Provides built-in approval workflows and payment scheduling

- Offers invoice processing, including two-way and three-way PO matching and approval to avoid overpayments

- Assists AP processes for subsidiaries and entities

Pricing:

Starts at $129 per month per user for the platform fee and charges for additional features separately.

Pros:

- Can manage supplier bank account details in a secure environment

Cons:

- Cannot use it for prepayment invoices on inventory purchases with the ERP system

- High foreign currency exchange fees

- Tax forms can be difficult to fill out and very difficult if you do not speak English

3. Airbase

Airbase is an automation solution for managing global AP processes. It focuses on ensuring compliance and syncing with your accounting tool to streamline the payment process.

Key features:

- Offers OCR to populate details, including general ledger (GL) category, date, amount, and purpose

- Supports onboarding with a self-service vendor portal and custom questionnaires

- Has a centralized dashboard with all key information about the invoice to avoid friction

- Accepts invoices from email or vendor portal across all subsidiaries

- Offers automated approval workflows based on multiple parameters, such as vendor, amount, GL category, etc.

- Enables three-way invoice matching to ensure compliance and reduce wasted spend

- Facilitates payments and approvals, including multi-subsidiary support, international currency, and real-time GL sync

- Real-time audit trail with receipts, notes, and documentation for transparency

Pricing: Request a custom quote.

Pros:

- Intuitive and easy to use; no training or previous knowledge required

- Seamless approval workflows

Cons:

- The mobile app is slow and takes time to load pages

- SSO-based login is not smooth

- Not suitable for complex branch-level approvals and expenses

4. Ramp

Ramp is an accounts payable solution designed to manage payments and business expenses. It automates bill entries, approvals, and payments while offering complete visibility and control. By tracking each AP step from data recording to approvals, it simplifies payment processing and takes the burden off teams.

Key features:

- Uses AI to automatically extract key details from invoices to offer accuracy and eliminate data-entry errors

- Identifies duplicate invoices and helps with two-way matching to purchase orders

- Offers custom approval workflows to minimize errors and ensure timely payments

- Provides a unified dashboard with visibility into the status of invoices

- Consolidates multiple payment options, such as check, card, same-day ACH, or international wire

- Integrates with accounting solutions, such as QuickBooks, Xero, Oracle NetSuite, Sage, etc. for auto-sync bill pay transactions

- Supports international payment processing in multiple currencies

- Tracks vendor data and transactions for easy reporting and data-driven decisions

Pricing:

Three pricing packages—free or basic features, $15 per user per month for Ramp Plus, and custom quote for enterprises with features like enterprise ERP integration, custom implementation, and local card issuance.

Pros:

- Works with multiple subsidiaries

- Offers cash back on credit card purchases made using VISA cards

Cons:

- Can’t unmatch an incorrectly matched invoice (invoice to credit card)

- Approval routing can only be set on the vendor level, not department level

- Limitations in syncing repayments

5. Bill

Bill is a spend management solution for SMBs to control payables, receivables, expenses, and all corporate expenses. It allows businesses to streamline scattered AP processes into a single platform and gain more control over their finances.

Key features:

- Enables tailored approval processes to facilitate approvals with minimal hassle

- Automates purchase order workflows with the option for automated two-way and three-way matching

- Simplifies expense reconciliation through quick coding and integration with accounting systems

- Automates receipt matching, categorization, and expense reporting, decreasing administrative tasks

- Syncs with all major accounting systems like QuickBooks, Sage, Intacct, and NetSuite

- OCR auto-populates invoices for data entry

- Provides bulk payments of approved invoices with payment choices, such as ACH, credit cards, checks, and international wire transfers

- Offers audit trail of any changes or actions related to the invoice on a single page

Pricing: Provides a free trial and essentials pack starting at $45 for six standard user roles. Its team and corporate pack are for $55 and $79, respectively. Enterprises need to request a custom quote.

Pros:

- One-click swift payments

- Minimum training required

- Easy-to-use mobile app

Cons:

- Customer support is difficult to initiate, slow, and unresponsive

- Frequent changes in the interface create confusion for users

- Limited customization options for reporting

6. Melio

Melio is a bill payment tool that enables businesses to pay via bank transfer and debit cards. Even when the vendor accepts only checks, it pays checks on your behalf to facilitate bill processing. It processes payments and issues checks without the payee having to use the platform. It is a tool suitable for small businesses to process payments without hassle.

Key features:

- Enables payments via credit card even when the vendor doesn’t accept the card to support deferred payments

- Allows inviting additional users (such as accountants) to set up roles and permissions and manage approvals easily

- Supports two-way sync with QuickBooks and Xero

- Facilitates bulk payments and split payments (splitting bills into multiple payments)

- Offers international payments across the border

- Raises duplicate payment alerts to assist in fraud detection

Pricing:

Free to process ACH payments to vendors; charges a fee for other payment modes (check Melio pricing)

Pros:

- Offers a free-to-use payment module (only with QuickBook)

Cons:

- Lack of integration with accounting software

- Turnaround time on a check is three business days

- Support is very limited

- Limits payments to two checks per month

7. Spendesk

Spendesk automates the AP process by bringing together purchase orders and invoices to facilitate budgets, payments, and approvals. It creates a single source of truth to cut hours of manual work and detect errors better. It is a cloud-based software that improves budget control and financial reporting.

Key features:

- Offers a centralized platform for tracking payments right from the purchase order stage

- Supports invoice capture via email and image/file upload

- Uses OCR to extract key information from the invoice, such as supplier name, amount, dates, and purchase details

- Enables budget changes in real time without a manual data-entry system

- Allows scheduling of payments and matching of purchase orders with the invoice for effective GRN matching

- Provides customizable and built-in approval workflows and controls to monitor spending

- Raises alerts for duplicate invoices to enable teams to avoid overpayments and defect frauds

Pricing:

Pros:

- Super convenient for ad-hoc expenses

- Intuitive and interactive interface

- Easy manual upload in case OCR doesn’t support receipt capture

Cons:

- Glitchy virtual card payments with delayed notifications and declined transactions

- OCR-based receipt capture only works for emails

- Basic features like memorizing accounting patterns for vendors are only available in the paid module

What are the benefits of accounts payable software?

Adopting AP software helps you in the following ways:

- Gives real-time visibility into the status of invoices and payments

- Provides insights into spending patterns, vendor performance, etc.

- Streamlines payment and approval workflows, leading to smoother payment processes and vendor relationships

How to choose a good accounts payable Software

Ease of use

The AP software must be flexible to accommodate complex hierarchies without making it difficult to follow the workflows. It should offer trigger-based workflows and a clean user interface. Your team shouldn’t struggle to learn how to use the product and rely on the support team to get basic invoices cleared.

Multiple payment options

From local transactions to international wire transfers and other digital payment options, AP software must support multiple payment options. It becomes easier with vendor-specific cards that make payments safe and fast. Pluto helps you set up vendor-specific cards, even for public relations officers. This is something most platforms on the market do not support.

Accurate data capture

AP software with OCR capabilities makes invoice processing faster and reduces errors. The ability to process invoices from different platforms and sources, such as emails, Slack, and WhatsApp, is required. Moreover, moving these captured invoices into the centralized database and syncing with accounting software eliminates the manual data entry task.

Approval workflow

Approval workflows are key for timely and accurate payments. An AP software must have a simple no-code workflow builder, even for complex hierarchies. This is especially useful for large organizations where this process can be intricate and long.

Integration

Vendor payments need to be recorded across accounting systems for effective reconciliation. The AP software must integrate with your accounting systems and platforms to automate data entry and facilitate a synchronized record-keeping system.

Centralized dashboard

The AP software should offer a dedicated dashboard with all the key information such as vendor, invoice number, status, description, etc. Also, it must give a separate centralized view for expense tracking. This gives you visibility into where you spend the most and helps you optimize resource allocation.

Supports GRN matching

The AP software interface must be designed in such a way that it supports GRN matching, both two-way and three-way matching. Be it in the form of OCR invoice capture or offering item-based matching capabilities. This will avoid any under- or over-payments and support a healthy vendor relationship. Also, this eliminates complications in the reconciliation process.

Reporting

Reporting capabilities of AP software help to identify the spending patterns and other key insights related to department-specific expenses, budgeting, etc. Hence, AP software must provide a dedicated reporting dashboard with the option to export the reports for enhanced analytics and reporting.

Transforming Accounts Payable with the Right Software

Accounts payable is not just about clearing bills and vendor payments. It is the basis for vendor relationship management and proper order in financial processes. From getting approvals to matching GRN, you need software that offers ease of use with the right blend of functionality.

Too complex of a product will leave your employees confused, leading to double work. Lack of customization will have teams work harder to adopt the product. Limited integration will have the accounting department working twice as much on data entry and syncing.

Make the right decision and choose software that gives you control, customization, security and speed, all while embracing automation capabilities.

Book a demo and discover how a simple automation tool transforms your AP process.

.png)

.png)